1–9 Unit Commercial Truck Insurance Pricing: The Ultimate Guide

If you own or operate a 1–9 unit trucking company, you’ve probably searched some version of:

How much does commercial truck insurance cost?

Why is my truck insurance so expensive?

Why do fleets pay less per truck than I do?

Is my insurance company overcharging me?

This guide answers those questions using real pricing data from Aronson Group’s insurance book not industry averages, not estimates, and not marketing fluff.

All insights below are based on:

WON deals (policies that bound)

LOST deals (quotes that did not bind)

Data normalized per truck, annualized, and grouped by fleet size, state, operation type, and years in business

Who Is Aronson Group?

Aronson Group is a commercial insurance agency that specializes exclusively in small trucking companies specifically 1–9 unit fleets.

While most insurance agencies focus on 10+ truck fleets, Aronson Group was built to serve the segment that makes up over 97% of DOT numbers on the road.

Key facts:

Insures 5,000+ trucking companies

Focused on owner-operators and small fleets

Access to exclusive trucking-only insurance markets

Quotes delivered in 24 hours or less

Our mission is simple: Give small trucking companies access to fair pricing and fast answers.

How Much Does Commercial Truck Insurance Cost for 1–9 Unit Fleets?

Short answer: it depends on fleet size, state, operation type, years in business, and credit but patterns are very clear.

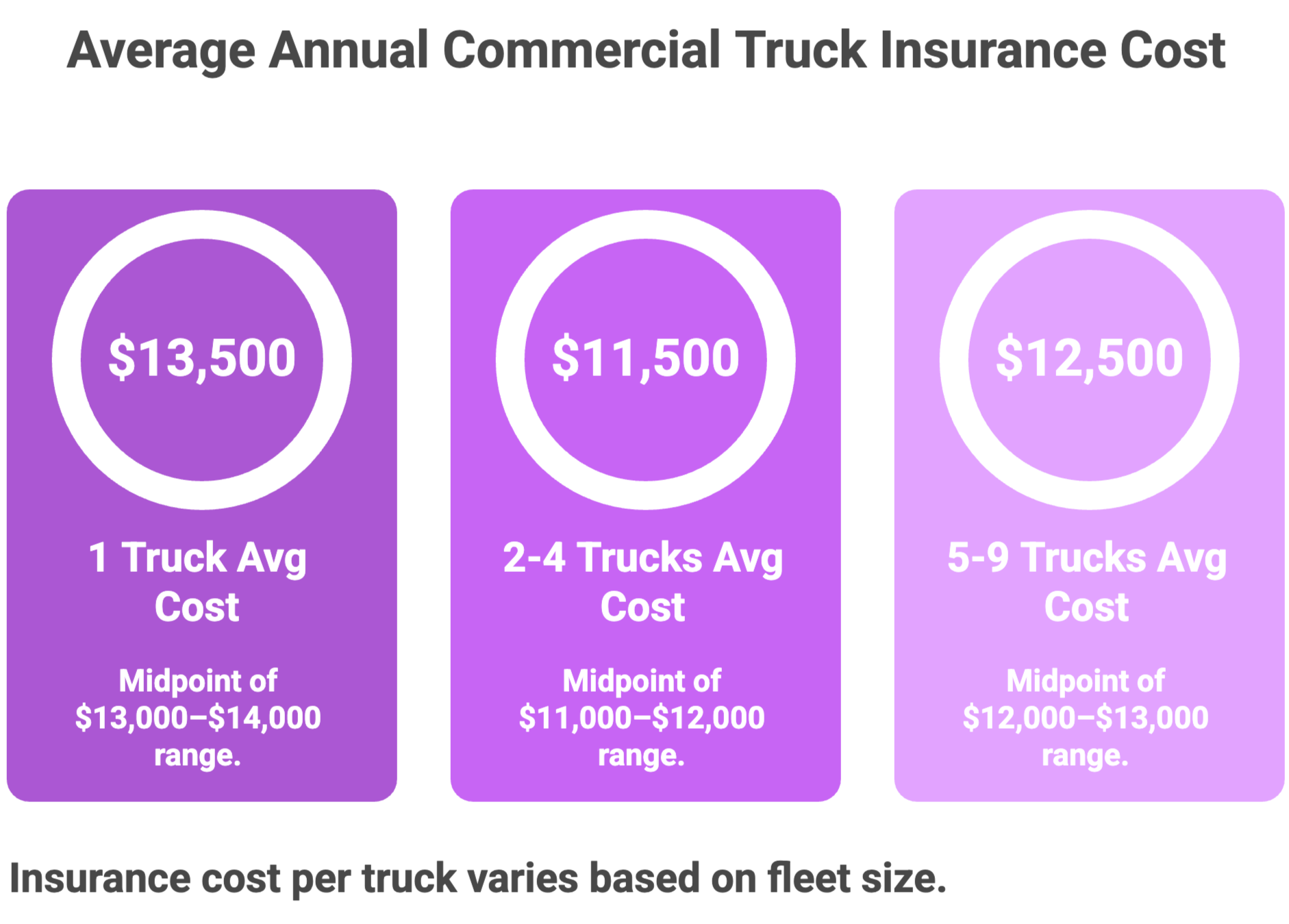

Average Annual Cost Per Truck (Based on Our Data)

| Fleet Size | Avg Cost Per Truck |

|---|---|

| 1 Truck | $13,000–$14,000 |

| 2–4 Trucks | $11,000–$12,000 |

| 5–9 Trucks | $12,000–$13,000 |

These are real bound premiums, not quotes.

Why Is Truck Insurance So Expensive for One-Truck Companies?

Because insurance companies penalize lack of scale.

From our data:

One-truck companies pay the highest cost per truck

New ventures (0–2 years) are hit hardest

Credit score can impact pricing 30–60%

One claim has nowhere to “spread out”

What We See in LOST Deals (1 Truck)

Avg quoted premium: ~$19,000 per truck

Median: ~$17,500

Extreme outliers much higher

One-truck deals usually don’t fail because the driver isn’t serious. They fail because the price is unworkable.

Are Owner-Operators Overpaying for Truck Insurance?

Yes, very often.

When one-truck companies bind with Aronson Group:

Premiums drop closer to $13K

Pricing stabilizes

Coverage improves

If you’re paying $15,000+ per year for one truck, there’s a strong chance you’re overpaying due to:

limited market access

being stuck with one carrier

new venture surcharges

poor policy structure

Why Do Fleets Pay Less Per Truck Than Owner-Operators?

Insurance carriers reward predictability and volume.

As soon as you add trucks:

Risk spreads out

Loss modeling improves

Underwriters relax pricing

What Our Data Shows

2–4 truck fleets pay $1,500–$2,500 less per truck than owner-operators

5–9 truck fleets gain leverage through structure, not just size

But here’s the problem: Many 2–4 truck fleets are still rated like single trucks.

Are 2–4 Truck Companies the Most Overcharged?

Yes, quietly.

This is the most mispriced segment we see.

WON Deals (2–4 Trucks)

~$11,000–$12,000 per truck

Fleet-style pricing when structured correctly

LOST Deals (2–4 Trucks)

Often already paying ~$9,000–$10,000 per truck

Didn’t switch because savings weren’t obvious

This tells us:

High-priced 2–4 truck fleets almost always switch

Low-priced ones need service + strategy, not just price

What Is the Best Time to Shop Truck Insurance?

Before renewal and especially around year two in business.

Years-in-Business Pricing Pattern

0–1 year: highest premiums

2 years: major pricing pivot

3+ years: stability improves fast

Many truckers miss this window and stay overpriced for years.

Does State Affect Truck Insurance Pricing?

Yes, but carrier access matters more.

Higher-Cost States (From Our Data)

Texas

Florida

Georgia

More Favorable States

Illinois

Indiana

Ohio

Much of the Midwest

Illinois stands out:

High volume

Extremely high close rates

Strong carrier participation

A driver in a “hard” state with the right carrier often beats a driver in an “easy” state with the wrong one.

Which Trucking Operations Are Hardest to Insure?

Bind More Easily

Dry van

Refrigerated

Standard flatbed

Intrastate operations

Face More Pricing Pressure

Hotshot (especially new ventures)

Logging

Livestock

Certain box truck operations

Hotshot operations showed near-zero bind rate in LOST data not because they’re bad drivers, but because underwriting models struggle to price them.

Why Do So Many Truckers Feel Ignored by Their Insurance Agent?

Because most agencies are not built for small fleets.

Common problems we hear:

Late renewals

One carrier option

No long-term plan

No explanation for increases

Large fleets get strategy. Small fleets usually get silence.

How Is Aronson Group Different?

We don’t treat 1–9 unit companies as “small accounts.”

We provide:

Multiple market access

Structured fleet placement (even for 1–2 trucks)

Clear education

Fast quoting (24 hours)

Long-term insurance strategy

Our job is not just to quote you it’s to make sure your insurance scales fairly as you grow.

How Do I Know If I’m Overpaying for Truck Insurance?

You’re likely overpaying if:

You pay $15,000+ per truck

You’ve grown past one truck but pricing didn’t improve

You’re approaching 2 years in business

You’ve never seen multiple carrier options

Your renewal always comes last minute

Final Answer: What Should 1–9 Unit Trucking Companies Do?

Stop guessing. Stop accepting “that’s just the market.”

Click the link below and compare your operation to real data. Quotes in 24 hours or less.